The global shipbuilding market is navigating a transformative phase, driven by rising maritime trade, technological advancements, and increasing demand for sustainable and specialized vessels. Valued at approximately USD 150.42 billion in 2024, the market is projected to reach USD 203.76 billion by 2033, growing at a compound annual growth rate (CAGR) of 3.43%.

Key Drivers of Shipbuilding Market Growth

1. Surge in Global Seaborne Trade

Maritime transport accounts for over 80% of global trade by volume, making it the backbone of international commerce. The rise in imports and exports, fueled by globalization and growing consumer demand in emerging economies, is driving demand for commercial vessels like container ships, bulk carriers, and oil tankers. For instance, global seaborne trade reached 12,027 million tons in 2022, highlighting the critical role of ships in supply chains.

2. Naval Defense Modernization

Governments worldwide are investing heavily in naval fleet modernization to enhance maritime security. For example, in January 2023, Canada awarded a USD 1.6 billion contract to Irving Shipbuilding for two Arctic patrol ships. Such defense contracts are boosting the military vessel segment, which is expected to grow at a CAGR of 7.1% through 2030.

3. Demand for Eco-Friendly Vessels

Stringent environmental regulations, such as the International Maritime Organization’s (IMO) 2023 and 2050 decarbonization goals, are pushing shipbuilders to adopt green technologies. LNG-powered ships, hybrid propulsion systems, and energy-efficient designs are gaining traction. For instance, Mitsubishi Heavy Industries is investing in ammonia-fueled ship designs to meet these standards.

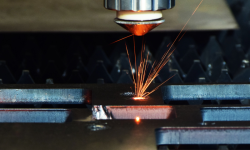

4. Technological Advancements

The shipbuilding industry is embracing digital transformation with innovations like digital twin technology, 3D printing, and AI-driven design optimization. Digital twins enable real-time monitoring and predictive maintenance, reducing costs and downtime. Automation and robotic welding are also enhancing production efficiency, particularly in Asia-Pacific shipyards.

Regional Insights

Asia-Pacific: The Shipbuilding Powerhouse

Asia-Pacific dominates the global shipbuilding market, accounting for 79.2% of revenue in 2023. China leads with a 50.2% share of global output, followed by South Korea and Japan. China’s shipbuilding output surged by 11.8% year-on-year in 2023, reaching 42.32 million deadweight tons (dwt). South Korea’s focus on high-value vessels like LNG carriers and Japan’s expertise in cruise ships further solidify the region’s dominance.

Europe and North America: Niche Growth

Europe is projected to grow at a CAGR of 4.8%, driven by green maritime innovations and cruise ship production. Germany’s competitive maritime sector supports its economy, while North America is seeing rapid growth due to naval defense investments and demand for commercial vessels.

Emerging Trends in Shipbuilding

1. Sustainable Shipbuilding

The push for sustainability is reshaping the industry. Shipbuilders are adopting alternative fuels like LNG and ammonia, alongside solar and wind-propelled designs, to reduce carbon emissions. These innovations align with global efforts to decarbonize maritime transport by 2050.

2. Autonomous Vessels

Autonomous navigation and smart ship systems are revolutionizing ship design. These technologies enhance safety, efficiency, and operational cost-effectiveness, positioning the industry for long-term growth.

3. Industry Consolidation

Mergers and acquisitions, such as Navantia’s acquisition, are driving industry consolidation. This trend enhances technological capabilities and addresses labor shortages, ensuring competitiveness in a dynamic market.

Challenges Facing the Shipbuilding Market

Despite its growth, the shipbuilding industry faces challenges:

- Labor Shortages: An aging workforce and lack of new talent, as seen in BAE Systems’ Florida shipyard, where the average employee age is 55, hinder expansion.

- Geopolitical Tensions: Trade disruptions, like the 2024 U.S. port strike, and geopolitical issues in the South China Sea impact demand and supply chains.

- Overcapacity: Excess capacity in container ship production could restrain growth in certain segments.

Opportunities for Growth

- LNG Trade Expansion: Rising demand for LNG carriers due to global energy needs presents significant opportunities.

- Fleet Modernization: Replacing aging fleets, particularly oil tankers and bulk carriers, will drive demand.

- Emerging Markets: Countries like India are investing in domestic shipbuilding capabilities, with India’s market expected to reach USD 8 billion by 2033.

Future Outlook

The global shipbuilding market is poised for steady growth through 2032, driven by technological innovation, sustainability initiatives, and rising global trade. Asia-Pacific will continue to lead, while Europe and North America carve out niches in cruise and military vessels. By leveraging trends like digitalization, green shipbuilding, and autonomous systems, the industry can navigate challenges and capitalize on new opportunities.